How to Find the Right Startups to Invest in

How to Find the Right Startups to Invest in

Investment is not only critical for startup founders. It’s also critical for angel investors and investment companies. There are many points to consider when it comes to finding a startup to invest in. So, how can you find the right startups for your investment? What are the points to consider meanwhile investing?

Why Is It Important to Invest in the Right Startup?

It’s crucial to find investment for startups that set out to solve a specific problem and provide helpful products and services. On the other hand, finding the appropriate startups to invest in might be a complicated process for angel investors and investment companies from time to time. As Forbes indicated, investment is a complex process that includes risk and uncertainty factors. Investing in the proper startups will please both the entrepreneur and investor in the upcoming processes. At the same time, a wrong investment negatively affects the investor financially and reputationally. So, investors should consider many points before investing in a startup. We can list these points as follows:

1) Decide Which Type of Investor You Are

There are typically two investor models in the startup ecosystem: Angel investors and venture capital (VC) firms. Angel investors usually provide financial support for small startups and companies at a high investment level. VCs, or venture capitalists, support startups with high growth potential in exchange for a stake in the company. If you prefer working alone, you might be interested in being an angel investor. Besides, those who work in teams usually invest together under an investment capital firm. As an investor, you should always primarily consider your focus and work and decide which investor you are.

2) Specify Your Field

One of the reasons why startups fail is because they try to go into multiple areas within the market before defining their own niche. Investors who discover and focus on a specific niche can evade this danger. They can also explore their personal and professional passions by turning toward startups offering straightforward solutions to particular problems. Many well-known investors are famous for their niche investment areas. For example, Swiss-born American investor, author, and philanthropist Esther Dyson has recently shifted her focus to the IT and healthcare markets. You should also specify your field according to your budget and focal point.

3) Strengthen Your Network and Channels You Follow

If you’re looking for proof of how important a network is, you can check many books, articles, and conferences written and still being written about. In addition to that, following international startup platforms and channels is also essential to discover suitable investment potential. You should closely examine your connections, social media interactions, and local & global platforms to reach accurate startups for investing. It’s also beneficial to keep up with current and emerging trends and share these issues with others.

4) Analyze Your Potential Investment in Detail

CBInsights’ study claims that 35% of startups fail because they couldn’t meet the market needs, whereas 38% fail because they couldn’t get investments. It means that a startup needs to address the right market and receive investment from the right investors. After discovering a potential startup to invest in, it needs to be analyzed in detail. You should deeply investigate how strong or weak a startup in the market needs. Ask “why” and “why now” for your potential investments. You are on the right track if you’ve strong answers regarding both the quantity and quality of the startup. Meanwhile, factors such as the passion of the startup team and if they know how they position themselves in the market help you make the right decision.

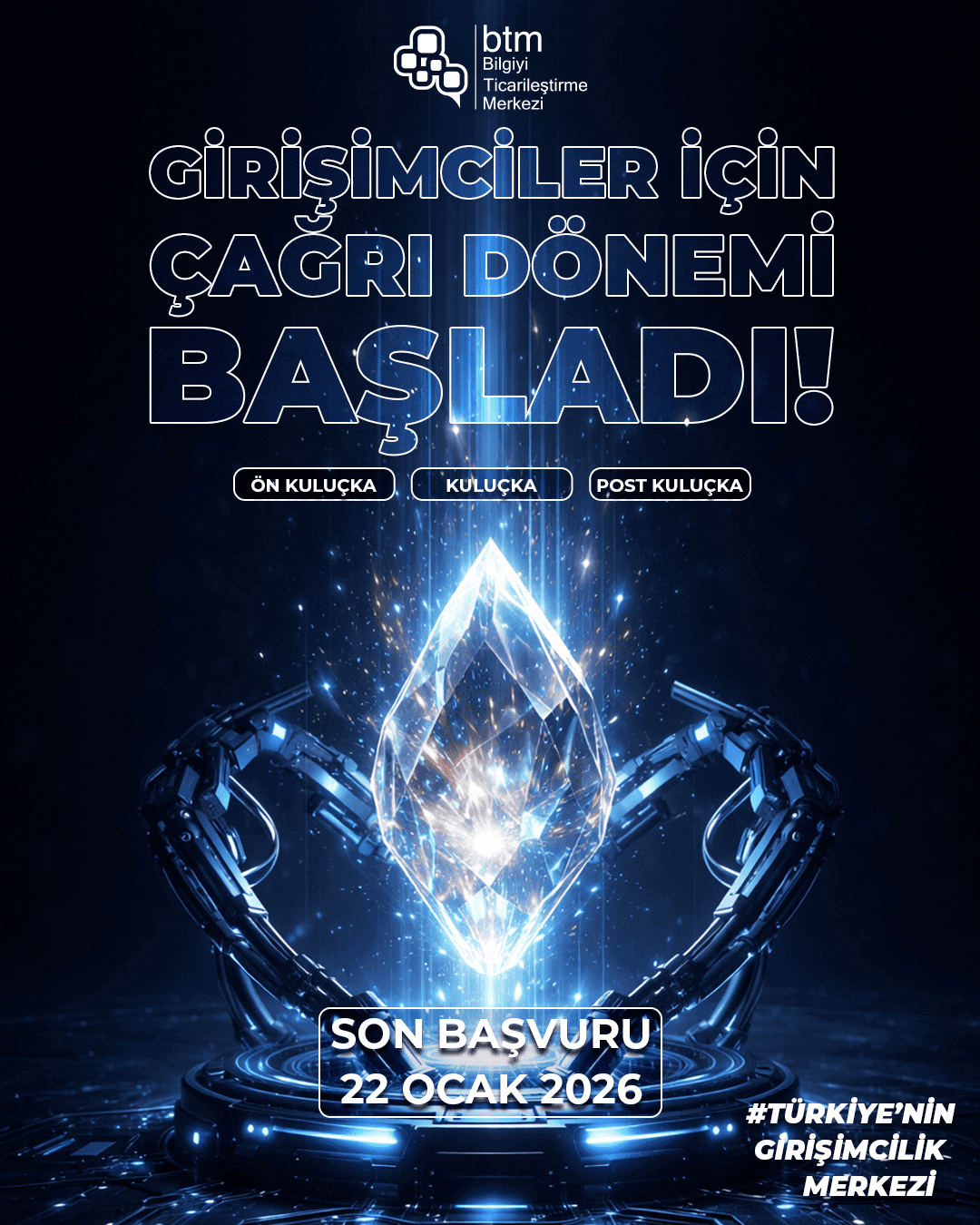

BTM is a structure that provides various services to companies in commercializing new business ideas and supports them in their growth process. In this blog post, we’ve covered the right ways to invest in startups and the fundamentals of it. You can check other BTM content for further useful information on establishing your own company and business model!